Have you ever considered the impact your investments make? Have you looked at the companies in which you’re investing and considered how they contribute to global problems or solutions? If you’ve wanted your investments to align with your values, you’re not alone. You just might not realize there’s a way to do so.

THE GROWTH OF SOCIALLY RESPONSIBLE INVESTING

Socially responsible investing (also known as sustainable, ethical, or conscious investing) is an investment strategy that aims to consider both financial return and social good to inspire social change. Think of it as an opportunity for doing well while doing good. Socially responsible investing, or SRI, has increased in popularity over the years, growing 76% between 2012 and 2014 from $3.74 trillion to $6.57 trillion assets, according to Envestnet PMC.

Particularly since the Trump presidency and a slew of government policy changes, demand for SRI has continued to steadily increase. Additionally, Millennials have shown significant interest in SRI, which has contributed to the growth. Investors want to be able to invest in companies that support issues they care about, whether that’s social programs, education, or the environment. Individuals investors can essentially target their concerns through their investment behavior and consumption decisions.

DOES SOCIALLY RESPONSIBLE INVESTING MAKE SENSE FOR YOU?

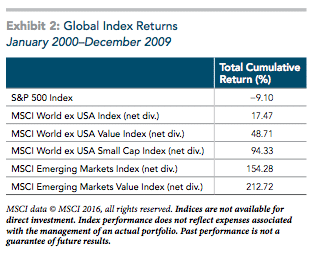

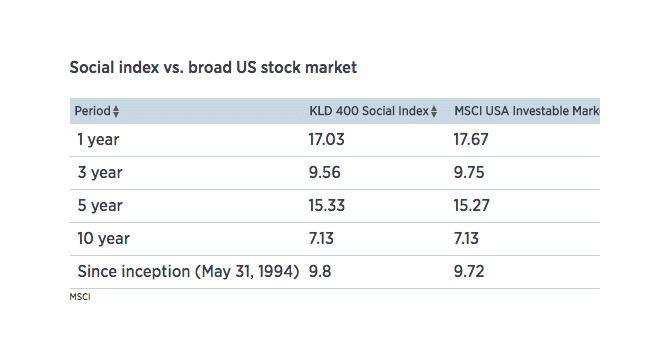

Investing in companies that support causes you care about while also generating returns is appealing to many investors, which is likely why SRI has steadily increased. However, opinions are still mixed about the impact of SRI strategies on performance. Some studies claim that socially responsible investments don’t perform as well as traditional stock market funds. Additionally, some of these investments come with higher annual fees. And, depending on the type of company in which you wish to invest, such as wind, solar, or other alternative energy funds, you may face more volatility.

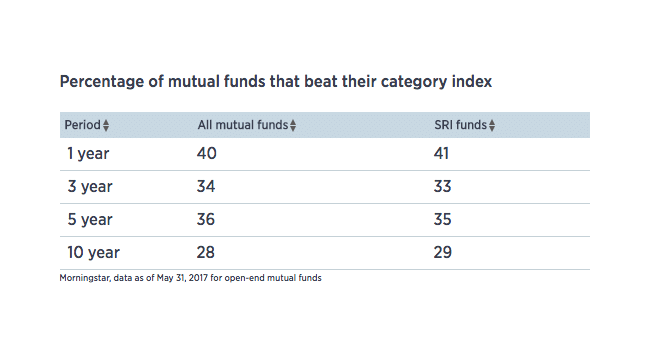

Morningstar reports that the average U.S. SRI mutual fund trails the benchmark S&P 500 index, but many funds that don’t fall into the SRI category have also fallen behind the market. As you can see, the jury is still out on whether or not sustainable portfolios experience a performance penalty.

Generally speaking, professionals recommend identifying reasons to invest in a stock, rather than focus on avoiding ones you don’t align with. Instead of focusing on stocks you don’t want to invest in, research those that you want to support.

FINDING BALANCE

Like any financial strategy, balance is key. Depending on your specific goals, you can incorporate SRIs into your portfolio. This gives you the opportunity to generate returns and save for your future while also supporting companies with social missions that align with your values.

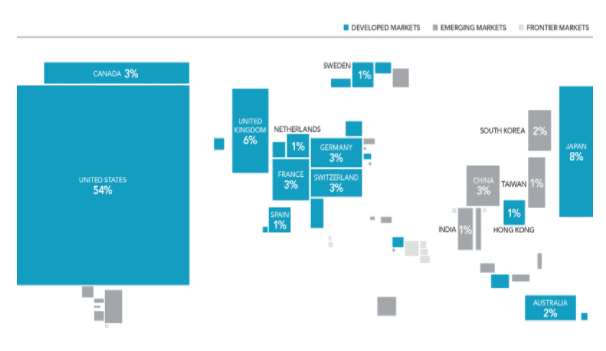

The first place to start is to speak with a financial advisor and discuss your investment goals, your social values, and how they can integrate. At Archer Investment Management, our investment approach is disciplined, unemotional, and highly diversified and we favor objective advice to “hot stocks” of the moment. The philosophy we follow is based on the science of investing that drowns out the noise of the media and focuses on time-tested and thoroughly-researched strategies that have been proven to drive returns, reduce volatility, and simplify the investment process.

Providing comprehensive investment guidance, we can help you evaluate your SRI opportunities. For a complimentary portfolio review, contact our office at 800-840-5946 or click here to schedule a phone call.

About Richard

Richard Archer is a financial advisor and the President of Archer Investment Management with more than eighteen years of industry experience. Largely working with successful individuals and couples, he specializes in providing comprehensive investment guidance and personalized care and attention to each client. Along with holding a Bachelor of Science in Economics and a MBA, he is a CERTIFIED FINANCIAL PLANNER™ certificant and a Chartered Financial Analyst®. He combines his advanced industry education and knowledge with his genuine care for people to provide clients with an exceptional experience. To learn more about Richard, connect with him on LinkedIn or visit www.archerim.com.