What’s a Sabbatical? Is it Right for You?

Finding terrible advice is very easy today? According to Certified Financial Planners, Advisors, and other money experts, here is the advice you should avoid.

Austin clients and friends, Scammers are getting savvier than ever in today’s tech-enabled world. This month’s Visual Insights Newsletter explores today’s common financial scams and how you can avoid getting snared. Check it out here!

They become anchors for how we evaluate opportunities (like companies and stocks) and our own sense of happiness.1

They also make us fixate on what could or should have been, not what’s right in front of us.1

When reality doesn’t line up with our expectations, unhappiness, resentment, and anxiety usually follow.2

These negative feelings can intensify when we sense uncertainty.3 We get anxious about our hopes, goals, and dreams for the future when we feel like everything’s unpredictable.4

Yet, it’s not impossible to be happy when life throws us a curveball and the future seems uncertain.

How can we find joy when things feel chaotic?

Gratitude.

When we’re grateful, we can let go of our expectations. That can lead to greater happiness and life satisfaction, no matter how uncertain the present is—or the future may be.5

We instinctively focus more on the negative than the positive. When times are tough, we expect the worst. To see things in a more positive light, we have to consciously set aside the negativity.6

Recalling happy memories is a quick way to do that. Even remembering a simple act of kindness can make you feel happier.7

Consider the interactions, experiences, or people who have changed the way you think about something recently. Think about what you’ve learned.

Change and uncertainty can test our strength and character. How we stand up to the challenge may not just change our perspectives. It can also keep us grounded and spark personal growth.8

It’s natural to take things for granted as we get used to them, even if they matter a lot to us. If we don’t take time to appreciate them while we have them, though, we may never get the chance.

Writer Robert Brault may have said it best with this: “Enjoy the little things in life because one day you’ll look back and realize they were the big things.”

“We do not remember days; we remember moments.” These words from Cesare Pavese ring true if you’re in your 20s, your 90s, or anywhere in between.

Whether you’re starting your career, raising kids, or enjoying retirement, recognize the good moments that are shaping this phase of your life. If you do, you’ll enjoy them far more as they’re happening.

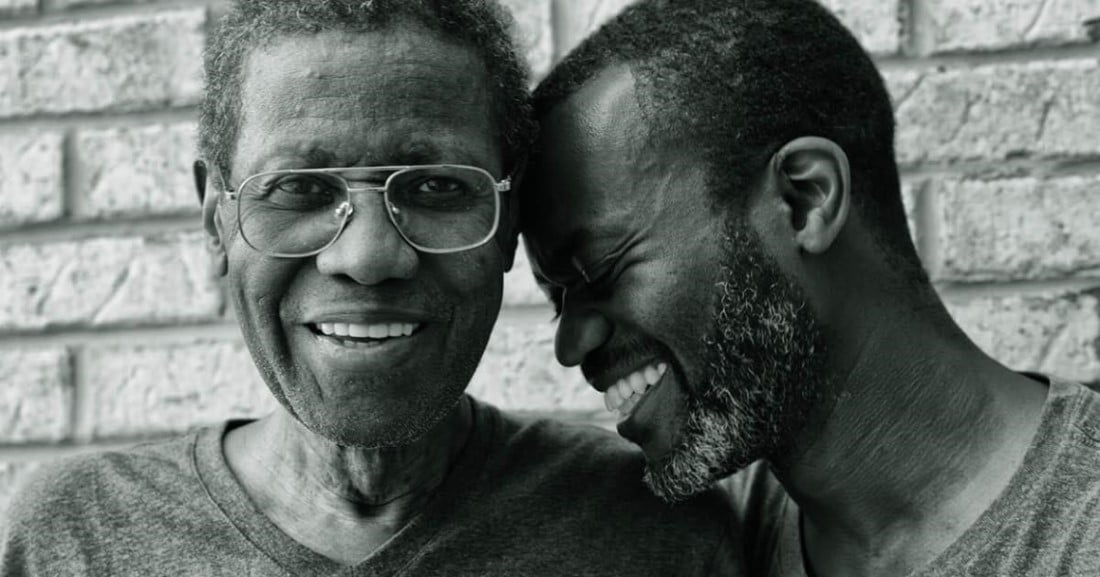

Some experiences create memories that last a lifetime. Family dinners, vacations, celebrations, major life milestones, and once-in-a-lifetime moments can shape us forever and for the better.9

They can also have positive impacts on the way we learn, see the world, and respond to unknown situations in the future.10

This doesn’t have to be extravagant. It can be simple, like some treasured part of your day or week.

It can also be unique and intangible, like a relationship you have with a friend, sibling, child, or spouse. In fact, these close relationships are the key to fulfillment and long-term happiness. Appreciating how special they are can help you make them stronger while bringing you more satisfaction.11

1 –The Psychology of Expectations

2 –The Subconscious Mind of the Consumer

3 – https://dash.harvard.edu/handle/1/3153298

4 – https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4276319/

5 – Giving Thanks Can Make You Happier

6 – Role of Emotion in Decision Making

7 – How Memories of Kindness Can Make You Happy

8 –Overcoming Obstacles to Personal Growth

9 – Life Experiences and Brain Structure

10 – Experience and Memory Formation

11 – Giving Thanks Can Make You Happier

12 – Thinking About the Future

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. These are the views of Finance Insights and not necessarily those of the named representative or firm, and should not be construed as investment advice.

In a perfect world, logic would always guide our financial decisions. Emotions wouldn’t come into play.

But we don’t live in a perfect world. Far from it.

That means our emotions impact our financial choices more than we realize.1

Shockingly as much as 95% of our purchase choices are made subconsciously, driven by our emotions—as little as 5% are based in logic (and that’s when we’re in a good headspace and feeling comfortable and secure).2

When we’re faced with uncertainty, fear and instinct can take over and push logic right out of the window.3

Your brain will make you want to react quickly to protect yourself and avoid the pain you anticipate from potential losses.4

Ironically, these instincts often make things worse. Emotional reactions can lead to poor choices and the losses you were trying to avoid in the first place.5

The best way to avoid letting your hardwired biases take over? Use these strategies. They can help you fare better in any crisis. They may even make you a savvier investor.

Click Here for full article and to sign up for our Visual Insights Newsletter!

“If you aim at nothing, you will hit it every time.” – Zig Ziglar

That’s true for most aspects of life, including our finances. Understanding the importance of financial goal setting can be crucial to success. Most of us realize that. It’s why we set New Year’s resolutions—and why more than half of all Americans set some type of financial goal as a resolution each year.1

As great as financial goal setting is, it won’t accomplish much for you if you can’t achieve them. And, maybe not so surprisingly, the vast majority of people (92% according to the research) don’t achieve their goals.2

Why do we (and I’m including myself here) struggle so much to meet the goals we set for ourselves? Is it because we don’t want to? Because we lack commitment? Not so much.

One big reason behind our failures is that most of us lack a clear connection between our present reality and the future we’d like to achieve. That vagueness can cut the emotional ties to a financial goal, draining the passion and commitment that actually lie within us.3 When we don’t connect to our goals at a deep level, it’s easy to get off track and lose our momentum. This is especially true for long term financial goals, which require sustained effort over time.

So, how can we stay on track to achieve our financial goals?

By reconnecting with the vivid emotions behind them and digging deeper to uncover our inner passions and motivations behind our goals.3 A simple way to dig deeper into the underlying reason for your financial goals is by peeling back the layers and asking yourself “why?” three times. This approach is particularly effective when aiming to meet your long term financial goals.

Start by asking yourself why you have set a specific financial goal: “Why do I want to (obtain this financial goal)?” Financial goals to earn more, save more, or build wealth are usually linked to a deeper desire, like the desire to have more time, more freedom, or an early retirement.

Answer this first question to help reveal the general motivation behind your financial goal. Financial goal setting is not just about numbers; it’s about the purpose behind those numbers.

People are like onions. Sometimes, you have to peel back more layers to uncover the clear vision behind your goals. When you’re able to dig deep and connect your financial goals to your innermost desires, you’ll stay excited about them for the long run. This approach is especially helpful when setting long term financial goals, as it keeps you motivated through the years.

For most people, financial goal setting takes time to achieve. From spending less to saving more, these goals take consistent effort and action. They can require you to change your habits, make sacrifices, and stay the course for years.

And that’s hard.

But it can be a lot easier if you’re able to stay connected to the “why” and the passion behind your goals. This is particularly important for long term financial goals, which might feel distant or abstract without a strong emotional connection.

Maybe you want more free time so you can enjoy special experiences with your family because you’ve missed important occasions before. Maybe you’re focused on creating a lasting foundation for your children because your family struggled while you were growing up. Perhaps you dream of owning a vacation home where your family can gather because you have fond memories of family gatherings in the past.

Why?

Because, if you’re truly passionate about your financial goals, you’ll stay excited about them for the long run. And that can mean you’ll be far more likely to work harder toward achieving your goals and you’ll be far less likely to give up on them.4

Of course, the financial goals you set today can change over time. With age and changing life circumstances, new financial goals can replace the ones you set 5, 10, or even 20 years ago. No matter when or why those goals may change, staying connected to the “why” behind them can go a long way to helping you achieve them. This flexibility is key in successful financial goal setting, especially as it relates to long term financial goals.

If you’re thinking about the “why” behind your financial goals and want to talk about them, give my office a call at 800-840-5946.

I’d love to hear more about your goals, why you chose them, and where you are at in your journey toward achieving them. I have a lot of experience helping my clients with their financial goals, and I look forward to the opportunity to help you, too.

Richard Archer, CFA, CFP®, MBAArcher Investment Management

1 How to Avoid Common Financial Mistakes

2 Science Says 92% of People Don’t Achieve Goals

3 Crush Saving Goals with Financial Psychology

4 Passion Budgeting and Fixing Finances

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. These are the views of Finance Insights and not necessarily those of the named representative or firm, and should not be construed as investment advice.

In this issue of the Visual Insights Newsletter, we’re sharing some great conversation starters for

talking about money with young people.

Many parents and grandparents find these important conversations hard to start. One survey found that at

least 36% of parents struggle to talk about money with kids, and more than 76% admit to only discussing

money with their children less than once a month.

Yet… 97% agree that teaching kids good financial habits is important.

Why the disconnect between knowing and doing?

Difficulty knowing how to start the conversation…

Fear that they won’t listen…

What’s stopping you? (I’ve got some great conversation starters for you right in this issue of the

Visual Insights Newsletter)

Do you worry that your past financial mistakes compromise your authority around money?

Not even close.

The mistakes you’ve made and the lessons they taught you are powerful.

One, because they’ve given you hard-earned wisdom to share.

Two, because these mistakes are relatable.

If you don’t know how to start these critical financial conversations, start with:

The financial mistake I’ve learned the most from was…

The thing I regret buying the most was…

My proudest financial accomplishment was…

When money was tight, I made it work by…

I am grateful for…

A person whose money wisdom I greatly respect is…

I’ve learned the most about money by…

The best way I know to build good financial habits is by…

To me, money represents…

When I’m deciding whether to buy something or save the money, I…

My most treasured possession is…

Go ahead and click here to check out other great conversations starters that can jump-start the

money talk with kids.

Are you thinking about more ways to teach the young people in your life good financial habits? Hit reply to

ask me a question.

Richard Archer is a financial advisor and the President of Archer Investment Management with more than twenty years of industry experience. He specializes in providing comprehensive financial planning and investment guidance and personalized care and attention to professionals with complex compensation and families pursuing financial freedom. Along with holding a Wharton Bachelor of Science in Economics and a Texas MBA, he is a CERTIFIED FINANCIAL PLANNER™ and a Chartered Financial Analyst®. He combines his advanced industry education and knowledge with his genuine care for people to provide clients with an exceptional experience. To learn more about Richard, connect with him on LinkedIn, Facebook, Twitter or visit www.archerim.com.

Would you rather plan a vacation or strategize your retirement? A Charles Schwab retirement survey found that Americans spend considerably more time and energy researching vacation possibilities and car purchases than planning for retirement. (1) And even if you are one of the few who has their financial ducks in a row, have you given any thought to the psychological transition that occurs when you reach this milestone? We know that money can only buy happiness if used intentionally, so let’s take a look at the three things women need to experience a fulfilling retirement.

Women tend to struggle with the social changes retirement brings more than men do. In fact, one study shows that 62% of women say they miss the daily social interaction they had at work, and retirement happiness for many women depends on the quality of their social life. (2) You may think that when you retire you will have all the time in the world to spend with family and friends, but the loss of your work community and routine make it difficult to maintain friendships.

To set yourself up for a happy retirement, create goals to get together with friends frequently and find ways to make new friends who are in the same season of life as you. You may meet people through volunteering, taking classes, or joining local retirement groups. It’s never too early to start investing in friendships and social ties that will help you ease into retirement.

When researching the effects of giving in retirement, Merrill Lynch found that women find great happiness from helping others and giving back to their community and are more likely to define success in retirement by generosity than their financial situation. (3) Approximately 68% of women also feel that retirement is the ideal time to give back. When your working years suddenly end, and you are left wondering what your purpose is, committing yourself to volunteer work gives your days meaning. Any kind of volunteering is beneficial to your psychological wellness, whether it’s shelving books at the library, walking dogs for the local animal shelter, or even giving your time to a cause related to your career.

While retirement may conjure up images of a slow-paced life with plenty of white space on the calendar, staying busy is the key to a happy retirement. (4) A recent retirement satisfaction survey found that 76% of retirees who were involved in more than ten activities, such as volunteering, creative pursuits, caring for others, socializing, and participating in sports, were more fulfilled in retirement than those who were involved in less than four activities.

In other words, having lots of time on your hands isn’t always a good thing. Enjoy the fact that you aren’t spending the majority of your waking hours at work, but purposefully plan your time so that you aren’t left twiddling your thumbs. Before retiring, make a list of things you want to do and places you want to go. Then, map out a strategy to make them happen. It’s easy to lose your identity when you say goodbye to your career, but setting goals and venturing out into new territory will help you build a new identity and prevent feelings of depression and anxiety.

At Archer Investment Management, we want to see women feel optimistic about their future. We also believe in taking steps today to plan for a thriving retirement. Let us help empower you by making sure you are on the right track and are considering every aspect of your life in preparation for retirement. Click here to schedule a phone call and take the first step towards a happy retirement.

Richard Archer is a financial advisor and the President of Archer Investment Management with more than eighteen years of industry experience. Largely working with successful individuals and couples, he specializes in providing comprehensive investment guidance and personalized care and attention to each client. Along with holding a Bachelor of Science in Economics and a MBA, he is a CERTIFIED FINANCIAL PLANNER™ certificant and a Chartered Financial Analyst®. He combines his advanced industry education and knowledge with his genuine care for people to provide clients with an exceptional experience. To learn more about Richard, connect with him on LinkedIn or visit www.archerim.com.

____________

(1) Debt Regret Fuels Financial Stress

Ah…spring is in the air. The days are getting longer, the birds are chirping, the lawn mowers are busy, and many of us are getting out the cleaning supplies to make our houses sparkle. But it might be the case that more than just your home needs to be decluttered, cleaned, and organized. Do your finances need some spring cleaning? Getting your financial life in order may seem daunting, but think of it as a way to contribute to your own financial success. Consider the following tips to get started on the path of financial organization.

Do you have a system for keeping track of your countless usernames and passwords? You’ll save yourself some headaches if you can find a method to keep all your information in one place. Plus, you’ll have the bonus peace of mind that your information will be safeguarded. There are plenty of online password managers to choose from, but however you decide to organize your login details, be sure to regularly update your passwords to protect yourself from hackers.

You don’t want to mess with identity theft. Not only can it cost you financially, but it causes undue stress, affects your credit, and could take years to resolve. Other than changing your passwords frequently, being cautious about releasing your personal information, and screening your emails, consider investing in an identity protection plan or credit monitoring service. If you experience the unthinkable, the professionals can take care of all the legwork and be your advocate.

Are you sick of all the paper that keeps piling up on your counters? Save a tree and get rid of clutter by enrolling in paperless document delivery for all your bills and financial services. Since you’re planning to create a password management strategy, the only thing you’ll need to do to access account details is find your login information and be on your way.

Another way to prevent the mountains of paper is to scan all your paperwork to a digital folder. This allows you to clear the files out of your home but still do your due diligence and have copies of pertinent information. If you aren’t using a cloud storage program, be sure to have a backup plan for your computer.

Do you like the idea of simplifying? Your finances might benefit from this approach. Do you have multiple bank accounts that you could consolidate? What about extra cash lying around that could be invested? Do you have rarely used credit cards? All of these things can be streamlined. Also, take a second look at your spending habits and create a budget that will help you stay on top of your finances.

If you’ve done all the work to create an estate plan, it would be beneficial for you to review it every 3-5 years. This will keep it up-to-date with any changes, such as divorce, beneficiary adjustments, change in trustee, or a modified financial situation.

A financial advisor is there to be on your side, helping you find ways to maximize your finances and meet your goals. If you don’t already have a financial plan, meet with your advisor to create one that is customized to your situation. This will allow you to map out when you want to retire, how you will pay for college, what socially-responsible investments are right for you, and how to fully fund your retirement and health savings accounts. If you are ready to streamline your finances and create comprehensive financial strategies for a secure future, schedule a phone call with us today!

Richard Archer is a financial advisor and the President of Archer Investment Management with more than eighteen years of industry experience. Largely working with successful individuals and couples, he specializes in providing comprehensive investment guidance and personalized care and attention to each client. Along with holding a Bachelor of Science in Economics and a MBA, he is a CERTIFIED FINANCIAL PLANNER™ certificant and a Chartered Financial Analyst®. He combines his advanced industry education and knowledge with his genuine care for people to provide clients with an exceptional experience. To learn more about Richard, connect with him on LinkedIn or visit www.archerim.com.