Tech is (still) booming.

Tech is (still) booming.

What do you really know about finance?

How would you rate your financial literacy?

Most folks say they’re very knowledgeable about financial matters.

But guess what?

Only about 1 in 3 folks can score 80% on a simple financial literacy quiz.

And only 7% answer every question right.

So, how will you measure up?

Can you beat 93% of your fellow Americans?

Let’s find out and take the financial literacy quiz.

What Your Bills Could Look Like in 2030

Sticker shock at the grocery store? Price hikes at the pumps?

Prices are going up and spending more for basics can be startling.

Do you remember the first time you noticed prices increasing? It often happens so gradually that we don’t even notice.

Inflation is often more complicated than we realize and it’ll be with us for the rest of our lives.

So, what could prices look like in 2030?

Let’s find out by looking at some historical data, and projecting how prices for things like food and housing could go up.

Cryptocurrency isn’t the black sheep it once was. It’s hit the mainstream, and it’s grabbing up more headlines and investors than ever before.

These days, about 1 in 7 Americans own some type of cryptocurrency. And a little more than half of them bought it for the first time in 2020.

Those numbers are likely to climb this year. That’s because more than a quarter of folks say they plan to buy cryptocurrency in the next 12 months.

With all the headlines, it’s hard to ignore all of the excitement.

And, yet, many also admit they still don’t know all that much about cryptocurrency.

Do you know the basics?

How much do you really know about cryptocurrency? To learn about tax loss harvesting for cryptocurrency read our blog.

Test your knowledge here and check out the facts to see if the cryptocraze lives up to all of the hype — and if it really makes sense for you to jump on the bandwagon.

A million dollars used to be the ultimate target for retirement portfolios. Retiring as a millionaire brought status and confidence that you could live comfortably during your golden years.

If you retired with $1 million in 1970, you probably didn’t have to worry about your nest egg running out, even with a lavish lifestyle. It would be like retiring with $6.9 million today.1

Retire with $1 million in the ’80s, and it would have been like retiring with $3.35 million in 2021.1

And in 1990?

A cool $1 million would have gone twice as far as it does these days.1

Clearly, $1 million doesn’t go as far as it used to.

Just how far could it go these days?

The answer depends on how and where you live.

In retirement, as in real estate, location is everything (or, at least, it’s a lot). The map below shows how long $1 million could last in each state. This state-by-state breakdown features a few different hypothetical growth scenarios and the results of our calculations.

Let’s see how long a $1 million nest egg could last where you want to retire — or wherever you’ve already retired.

These tactics can transform your goals & your life.

Austin clients and friends, Scammers are getting savvier than ever in today’s tech-enabled world. This month’s Visual Insights Newsletter explores today’s common financial scams and how you can avoid getting snared. Check it out here!

The coronavirus-driven recession and uncertainty will make retiring in Austin within the next 5 years challenging. The record volatility, recent legislation, and economic disruption mean that the decisions you make next will define your retirement. Create confidence in your plan for a work-free life by downloading this free checklist. Worried about what’s going on and want advice now? I save a few appointments each week — grab one by calling 800-840-5946.

Austin retirees and those facing retirement soon, the pandemic and economic crisis mean historic levels of uncertainty. To learn how to retire comfortably in uncertain times, please download this FREE guide. Need advice now? I save a few appointments each week — grab one by visiting https://archerim.com/call.

They become anchors for how we evaluate opportunities (like companies and stocks) and our own sense of happiness.1

They also make us fixate on what could or should have been, not what’s right in front of us.1

When reality doesn’t line up with our expectations, unhappiness, resentment, and anxiety usually follow.2

These negative feelings can intensify when we sense uncertainty.3 We get anxious about our hopes, goals, and dreams for the future when we feel like everything’s unpredictable.4

Yet, it’s not impossible to be happy when life throws us a curveball and the future seems uncertain.

How can we find joy when things feel chaotic?

Gratitude.

When we’re grateful, we can let go of our expectations. That can lead to greater happiness and life satisfaction, no matter how uncertain the present is—or the future may be.5

We instinctively focus more on the negative than the positive. When times are tough, we expect the worst. To see things in a more positive light, we have to consciously set aside the negativity.6

Recalling happy memories is a quick way to do that. Even remembering a simple act of kindness can make you feel happier.7

Consider the interactions, experiences, or people who have changed the way you think about something recently. Think about what you’ve learned.

Change and uncertainty can test our strength and character. How we stand up to the challenge may not just change our perspectives. It can also keep us grounded and spark personal growth.8

It’s natural to take things for granted as we get used to them, even if they matter a lot to us. If we don’t take time to appreciate them while we have them, though, we may never get the chance.

Writer Robert Brault may have said it best with this: “Enjoy the little things in life because one day you’ll look back and realize they were the big things.”

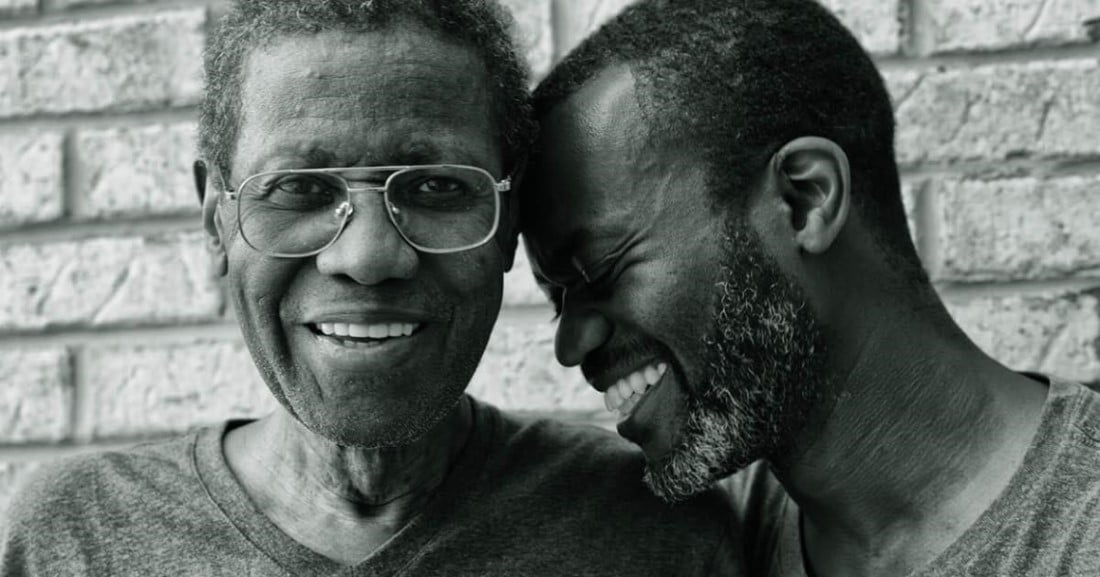

“We do not remember days; we remember moments.” These words from Cesare Pavese ring true if you’re in your 20s, your 90s, or anywhere in between.

Whether you’re starting your career, raising kids, or enjoying retirement, recognize the good moments that are shaping this phase of your life. If you do, you’ll enjoy them far more as they’re happening.

Some experiences create memories that last a lifetime. Family dinners, vacations, celebrations, major life milestones, and once-in-a-lifetime moments can shape us forever and for the better.9

They can also have positive impacts on the way we learn, see the world, and respond to unknown situations in the future.10

This doesn’t have to be extravagant. It can be simple, like some treasured part of your day or week.

It can also be unique and intangible, like a relationship you have with a friend, sibling, child, or spouse. In fact, these close relationships are the key to fulfillment and long-term happiness. Appreciating how special they are can help you make them stronger while bringing you more satisfaction.11

1 –The Psychology of Expectations

2 –The Subconscious Mind of the Consumer

3 – https://dash.harvard.edu/handle/1/3153298

4 – https://www.ncbi.nlm.nih.gov/pmc/articles/PMC4276319/

5 – Giving Thanks Can Make You Happier

6 – Role of Emotion in Decision Making

7 – How Memories of Kindness Can Make You Happy

8 –Overcoming Obstacles to Personal Growth

9 – Life Experiences and Brain Structure

10 – Experience and Memory Formation

11 – Giving Thanks Can Make You Happier

12 – Thinking About the Future

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. These are the views of Finance Insights and not necessarily those of the named representative or firm, and should not be construed as investment advice.