Life has changed; how do we adapt without losing sight of what we want to achieve?

As you’ve heard me say before, no one knows how the future will play out, but we should still look ahead and think through the consequences of what’s happening. (More about this kind of second-order thinking ahead.)

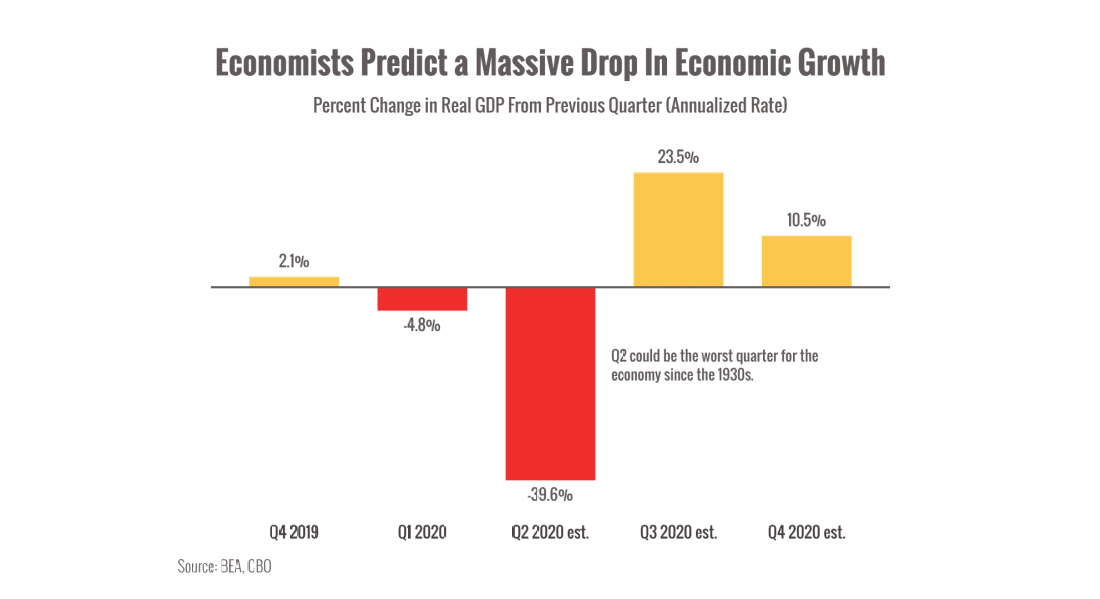

I believe that our society and our economy are experiencing a massive paradigm shift.

We will never go back to the world we had before COVID-19, and the lens that we used to evaluate ideas, markets, economies, and personal choices over the last decade may not be sufficient for the next decade.

Here are just a few things that I see changing as a result of what’s going on now:

Social Support: 36.5 million Americans have become unemployed in two months, and the effects are rippling through families, communities, and the economy.1 The government has responded with trillions of stimulus dollars to individuals and businesses. More relief is likely to come. What does this mean for our society? Who should get a helping hand in tough times? Will we permanently expand the social safety net?

Work: Thrown into the largest work-from-home experiment in history, more workers and employers will transition to remote work post-pandemic. This shift in work has major implications. Which places will be a draw if workers can live anywhere and employers can have their pick of a nationwide (or global) workforce? Will those who must physically show up demand different compensation?

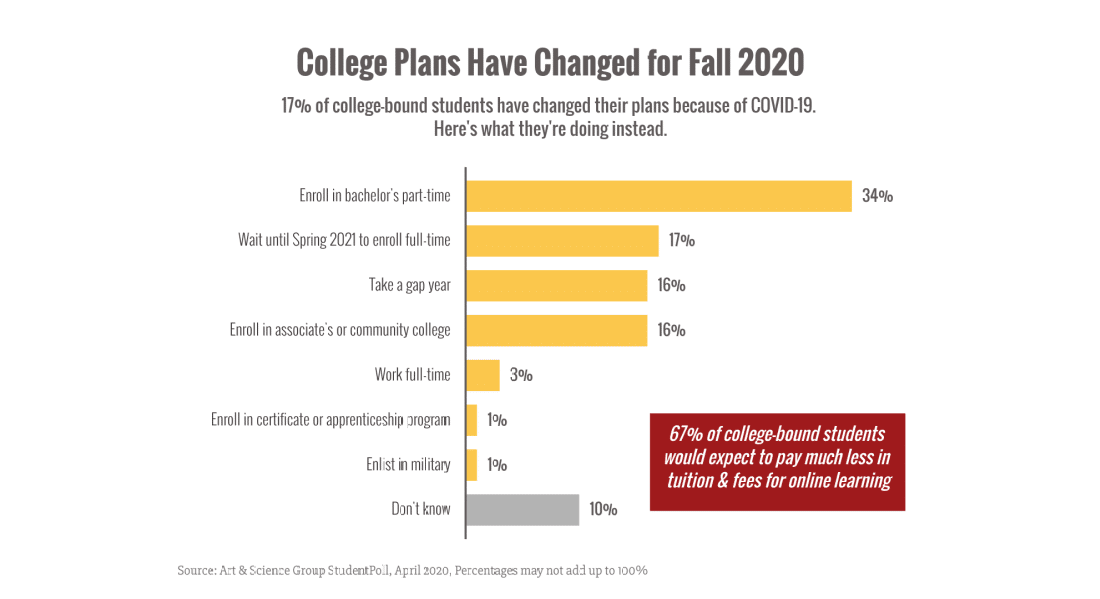

Education: Students, parents, schools, and universities are being forced to re-evaluate the definition of education (and its price tag) now that the on-campus experience has gone online. What’s missing if you attend from home? How much should education cost? What alternatives to a traditional four-year degree will arise?

Shopping & Entertainment: Brick-and-mortar retailers may never recover from the body blow dealt by pandemic lock-downs. Online shopping, grocery delivery, and digital services may finally overtake offline channels. What will the retail landscape look like when it’s easier (and maybe safer) to eat, shop, and watch at home?

No one has all the answers about the new world and things are not always what they seem.

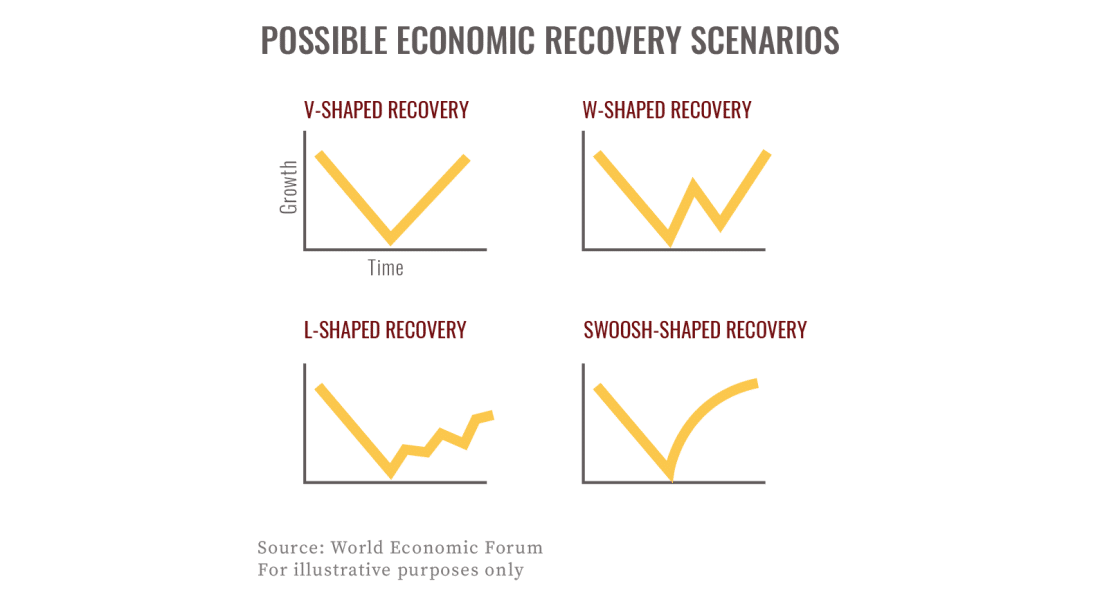

Though it appears that the stock market has moved past the pandemic, we shouldn’t celebrate just yet.

Why?

Much has changed in the world and we’re still playing out first-order effects. More consequences are coming.

“What are the second- and third-order consequences of this?” is a question big thinkers like Ray Dalio (Manager of the largest hedge fund in the world) ask about complex scenarios.

Here’s what they mean:

First-order thinking is fast and simple: B is the logical outcome of event A.

But then what? What happens as a consequence of B?

And what happens as a result of that? And what is the follow-on effect of that?

Second-order thinking is about interactions and complex systems. It’s slow and hard (but mastering it can put us steps ahead of the crowd).

Understanding the new world that’s growing out of the pandemic requires thinking through these higher-order consequences and developing a new lens to navigate the uncertain waters ahead.

How can we adapt? How can we still pursue our goals in a totally different world?

We think it through with humility and an open mind.

We hone our second-order thinking skills by asking: what could happen? And then what? How likely is it that I’m right? What could happen if I’m wrong? How do I position myself?

We’ll do it together.

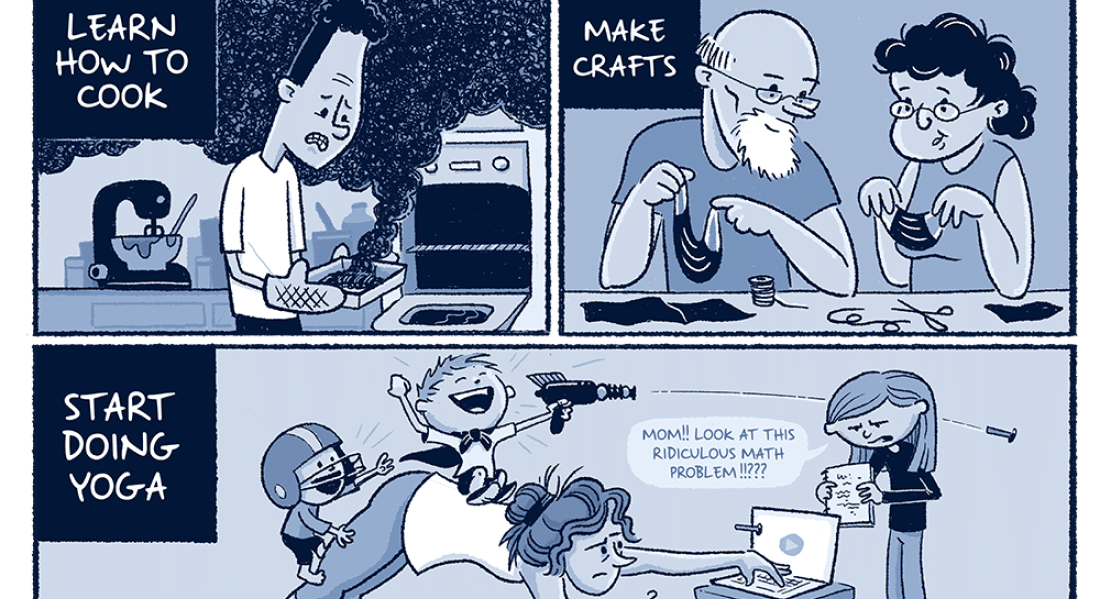

COVID-19 is going to be with us for the rest of 2020 and possibly into 2021. So we’re adapting.

At Archer Investment Management, it means we will continue to hold virtual client meetings for the foreseeable future. We are happy to reopen our office once we know more.

It also means big changes in our personal lives. Many of our children will be attending school online through the end of the school year and maybe even this fall.

Our anticipated summer vacation to Disney Magic Kingdom is canceled, but we’re hoping to spend time on Lake Austin instead.

We’re taking it day by day and thinking through those higher-order effects.

How about you? What changes are you making to your plans this summer and fall?

P.S. A number of clients and friends have reached out to talk through options around a potential lay-off, buy-out offer, or early retirement. If this is on your mind, please let me know. We can work through it together.

P.P.S If you’ve got a kid in college this fall, I have a question for you: is virtual university still a compelling offer? Are you and your student considering a gap year or some alternative? Please let me know. I’m interested in learning from your experience.

1https://www.washingtonpost.com/business/2020/05/14/unemployment-jobless-claims-coronavirus/

Chart source: https://www.artsci.com/studentpoll-covid-19-edition-2

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Risk Disclosures: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. The S&P 500 is an unmanaged composite index considered to be representative of the U.S. stock market in general. All index returns exclude reinvested dividends and interest. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. For illustrative purposes only.