Everyone you and I have ever met has been affected by the Coronavirus.

My childhood friends in Indiana, the folks I met in London last summer, and even Brad Pitt.

It’s likely that every human on the planet has been affected by COVID-19.

I’m not sure that this kind of event has ever happened before in human history.

Though it’s sad that it took a disease to bring us together, it reminds me of how deeply connected we all are and how much our daily existence depends not just on our community, but on people we’ll never meet in far-flung corners of the world.

That very interconnectedness is what’s making this pandemic so dangerous to us and the economy.

Economists believe we entered a recession in March, and the latest data continues to show the economic damage:1

- Retail sales dropped 8.7%, the biggest drop since the government started tracking the data in 1992.2

- Spending on travel, restaurants, and shopping overall is way down (though grocery sales and delivery are up).3

- The number of new unemployment claims skyrocketed to 22 million, erasing the job gains since June 2009.4

Despite the ugly economic data, stocks just wrapped their best performance in decades.5 What gives?

“Irrational exuberance,” to quote Alan Greenspan. Stocks are famous for rallying in the face of bad numbers, and it’s clear that investors are expecting government stimulus to lead to a quick recovery as states emerge from lockdown and business picks up.

Are bullish investors right? Will the economy recover quickly?

It’s impossible to say right now. How long the downturn lasts and how soon the economy recovers depend on answers to some critical questions:

- When will widespread testing, tracing, and treatment allow lockdowns to ease? Reopening America too soon and igniting a fresh wave of the pandemic will prolong the pain.

- Will employers maintain relationships with their laid-off staff? You can’t just flip a switch and reopen a closed business without skilled workers. The longer the shutdowns continue, the harder it will be for companies to staff up.

- How soon will consumer spending return? “Deferred” demand that’s pent up and just waiting for restrictions to ease could cause spending to surge; “destroyed” demand that’s not coming back could cause spending to remain depressed for longer. Here’s a simple example: deferred demand would be rescheduling a canceled vacation. Destroyed demand would be deciding to skip it entirely.

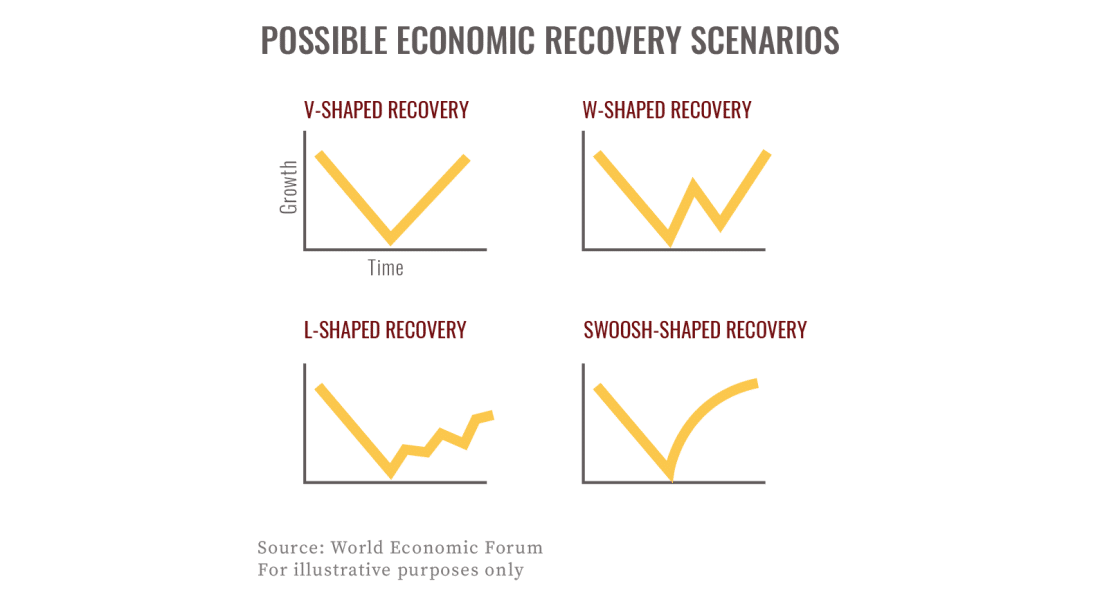

V, W, L, or Swoosh?

The “shape” of the eventual recovery is being hotly debated because it gives us insight into what would need to happen (and how long it could take).6

“V-Shaped” Recovery: A short, sharp decline and then a quick rebound is the best-case scenario. In this case, lockdowns lift soon and spending surges, driven by pent-up demand and government stimulus.

“W-Shaped” Recovery: A “double-dip recession” is a worst-case scenario that could happen if the easing of restrictions leads to another wave of infections and lockdowns, or the economic damage causes a second downturn.

“L-Shaped” Recovery: An L represents a sudden plunge and fitful recovery if lockdowns continue through the year and growth is slow to return.

“Swoosh-Shaped” Recovery: A tick or swoosh is a sharp downturn followed by a gradual recovery as lockdowns are eased cautiously across the country.

We can’t predict what the road ahead will hold, but I think it’ll look less like a return to “normal” and more like a way to live with the way COVID-19 has overturned ordinary life.

What do you think? Will your life be back to normal this summer?

1https://www.cnbc.com/2020/04/15/us-retail-sales-march-2020.html

2https://www.msn.com/en-us/money/markets/coronavirus-delivers-record-blow-to-u-s-retail-sales-in-march/ar-BB12FaEi

3https://www.nytimes.com/interactive/2020/04/11/business/economy/coronavirus-us-economy-spending.html

4https://finance.yahoo.com/news/coronavirus-covid-weekly-initial-jobless-claims-april-11-192401571.html

5https://www.wsj.com/articles/the-stock-market-is-ignoring-the-economy-11587160802

6https://www.weforum.org/agenda/2020/04/alphabet-soup-how-will-post-virus-economic-recovery-shape-up/

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.