Divorce is Painful: Financial Planning for Divorce and Achieving the Best Financial Outcome

As wonderful as marriage can be, there’s no denying the fact that around 50% of marriages in the United States end in divorce. (1) Regardless of the reason for the separation, a divorce can be painful, emotionally draining, overwhelming, and expensive. While there’s no avoiding the emotions that come with such a significant life event, you may be able to reduce some of the stress and financial implications if you prepare ahead of time.

Why Financial Planning for Divorce is Important

There’s no doubt about it; divorce can absolutely devastate your financial situation. Financial planning for divorce is critical to avoid financial pitfalls. Think about it this way: in order to maintain the same standard of living post-split, individuals would need more than a 30% increase in income. (2) And it’s even more challenging when children are involved. Since most children live with their mother after a divorce, one in five women find themselves in poverty due to the financial burden associated with taking care of the children.

Don’t let yourself become a statistic. Before you file papers for a divorce, make sure you’ve reviewed these tips that will help you plan for the best financial outcome:

Guard Your Emotions During Divorce

We all know that it’s unwise to make financial decisions based on emotions, but it’s easier said than done. When walking through a divorce, both sides often try to take out their feelings on the other. Try to avoid this behavior at all costs by focusing on the tasks at hand and turning to your advisor to help you keep a clear head about what really matters.

Because there are so many difficult decisions to be made, don’t rush the process. As unenjoyable as a divorce is, you want to carefully consider each decision. The choices you make will have a long-term impact. Effective financial planning for divorce involves taking the time to make rational and informed decisions.

Understand That Everything is Fair Game

When splitting up assets and liabilities, almost everything is up for grabs, even things that are in only one person’s name. Whether it’s credit card debt or frequent flyer miles, understand that it all needs to be negotiated. There’s one area where this doesn’t apply; gifts and inheritances that are linked to one spouse only are not at risk of division unless they are commingled with other assets.

When you are entering marriage, it’s understandable that you don’t want to think about a future divorce. But with the high rate of divorce from first marriages and the shocking fact that subsequent marriages have an even higher chance of failure (3), it’s worth it to consider a prenuptial agreement or at least create an inventory and valuation of assets prior to marriage. Preparing an inventory of assets is a crucial step in financial planning for divorce.

Plan Your Purchases Before Filing

If you know you have a significant purchase on the horizon, make the acquisition before filing for divorce. Once the papers are in the hands of the court, many states prevent people from making big purchases through an automatic financial restraining order. Strategically planning purchases is a part of comprehensive financial planning for divorce.

Gather Evidence and Documentation

Despite the emotional toll of divorce, it’s vital that you are thorough in your organization. Since you’ll want an accurate record of the assets you own and the debts you owe, start a list of all marital assets and liabilities. Of course items like your home and cars are important to include, but remember to list other assets including artwork, pensions, inheritances, second homes, and other valuables. It might be worth it to take photos of your assets, make copies of account statements, and have a record of all important numbers.

Proper documentation is a critical aspect of financial planning for divorce to ensure fair division of assets and liabilities.

Be Honest About Your Assets

Hiding assets is not the way to go. If you try to conceal something from your spouse and it is discovered later, you could lose your credibility in court and face penalties. Transparency is key in financial planning for divorce to avoid legal repercussions and ensure a fair process.

Know That Non-Alimony Money is Not Taxable

If you receive a transfer of money as a result of the divorce agreement, you will not face taxes on that income. While alimony is taxable, any other payouts escape taxation. Unfortunately, the party paying the cash will not benefit from a tax break.

Consider a Mediator to Reduce Costs

Other than double the living expenses and loss of income, divorce can devastate your finances due to all the legal fees involved! The average cost of a contested divorce ranges from $15,000 to $30,000. (4)

If you want to avoid these high fees, use a mediator who will facilitate agreements and help you avoid hefty legal costs. Using a mediator can be a smart choice in financial planning for divorce to keep costs down.

Update Beneficiaries Immediately

With all the paperwork and life upheaval, many people forget to update their beneficiary designations. It’s common for married couples to have each other listed on their accounts, so if the unthinkable happens and you pass away, your ex might end up with your assets. Make a list of all accounts that have a beneficiary listed and make the changes right away. Updating beneficiaries is an essential task in financial planning for divorce.

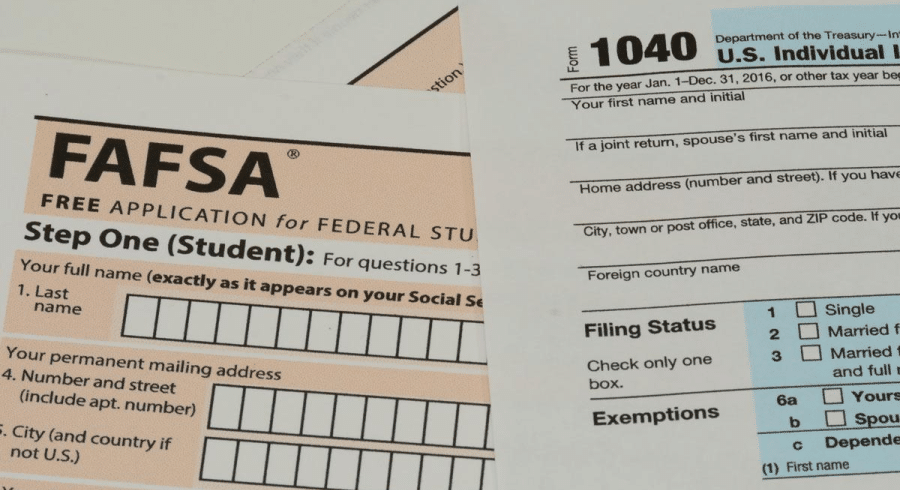

Educate Yourself About Finances

In many marriages, one spouse will take on the responsibility of handling all financial matters from budgeting to paying bills. In a divorce, that can mean the other spouse is completely clueless about their financial situation as well as how to manage finances on their own.

If you aren’t in charge of your household’s finances, you’ll want to review accounts and get a handle on everything you and your spouse own before starting the divorce process. It’s important that you understand your current income, savings, regular bills, and debts. You may be assuming you have more or less than you actually do, or you may discover a loan or account you weren’t aware of.

By obtaining a big picture of your finances, you’ll have an idea of what you and your spouse will split, how you’ll handle your children’s expenses, and other financial decisions that will have to be made. Education is key in financial planning for divorce to ensure you are prepared for financial independence.

Plan for the Future Post-Divorce

Going through a divorce is hard enough; you want to get back on your feet as quickly as possible without another series of hurdles and roadblocks. Although many people will experience a divorce in their lifetime, few are prepared for all the details that need to be handled after the divorce settlement is in place in order to restore peace of mind and independence.

Once the divorce is finalized, it’s time to move forward. You’ll need to create your own budget, determine new goals, and review your investments to ensure they line up with your personal risk level. For many, this can be overwhelming, but divorce is not the nail in your financial coffin. Find a financial advisor who can walk you through the process and help you set yourself up for success. If you or someone you know is going through a divorce, I’m here to help. Click here to schedule a phone call.

About the Author: Richard Archer

Richard Archer is a financial advisor and the President of Archer Investment Management with more than eighteen years of industry experience. Largely working with successful individuals and couples, he specializes in providing comprehensive investment guidance and personalized care and attention to each client.

Along with holding a Bachelor of Science in Economics and a MBA, he is a CERTIFIED FINANCIAL PLANNER™ certificant and a Chartered Financial Analyst®. He combines his advanced industry education and knowledge with his genuine care for people to provide clients with an exceptional experience. To learn more about Richard, connect with him on LinkedIn or visit www.archerim.com.

_____

(1) https://www.mckinleyirvin.com/Family-Law-Blog/2012/October/32-Shocking-Divorce-Statistics.aspx

(2) https://divorce.usu.edu/files-ou/Lesson7.pdf

(3) https://proactiveadvisormagazine.com/financial-impact-of-divorce/

(4) https://info.legalzoom.com/average-cost-divorce-20103.html