The Costs of Kids

IT’S NO SECRET THAT KIDS COST MONEY.

Table of Contents

But how much do they really set you back?

For the average American parent, raising a child comes with a price tag of at least $12,980 every year. By the age of 17, that’s well over $230,000—and that’s before college costs come into play. High-earning families spent even more—over $370,000 according to the research. 1

Of course, child-rearing costs vary from family to family, and it’s far more expensive to raise kids in some high-cost-of-living states, like Oregon and New York.2

Plus, kids don’t magically stop costing you money once they turn 18. College, rent, insurance, and helping out adult children can all add up.

No matter how old your kids are, spending money is an unavoidable part of raising them.

What does that money go toward?

Here’s a breakdown of the biggest costs of raising kids.

WHY KIDS COST SO MUCH MONEY

(Source: USDA, 2015)

CHILDCARE

$2,000-$22,600 PER YEAR3

Whether it’s school programs, babysitters, or full-time care, parents can spend a shocking amount of money on childcare. However, the benefits of career stability to parents and the socialization and stimulation children can receive in high-quality care, can make the expense a worthwhile choice for many.

HEALTH CARE

$1,150-$3,170 PER YEAR

Parents have to shell out for out-of-pocket doctor and dentist visits as well as health insurance premiums, prescriptions, and other medical expenses. While adults may spend more on their own health care expenses (especially as they age), health care costs for the under-18 crowd had the highest rate of inflation, meaning parents may end up spending even more in the years to come.4

HOUSING

$3,600-$5,500 PER YEAR

Housing is the single biggest cost of raising children. Whether it’s buying a bigger house, or finding a good school district, about $1 in every $3 spent on kids goes toward keeping a roof over their heads.

FOOD

$2,300-$3,500 PER YEAR

Picky eaters or not, food costs add up. It’s also not uncommon for parents to shell out more for organic or all-natural foods. Good news, though: splurging on healthy food may actually save money later when it comes to health care costs.5

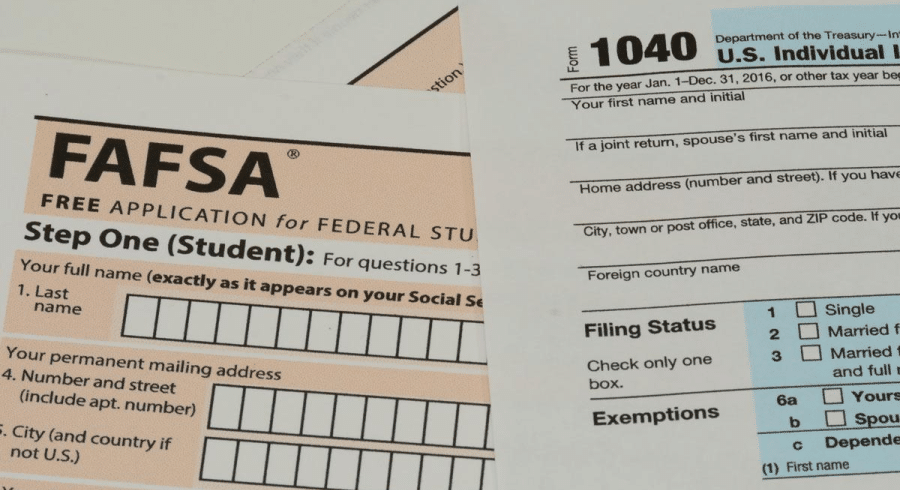

COLLEGE

$10,400-$36,800+ PER YEAR

Though the individual cost of college varies, tuition costs double about every decade.6 Since college graduates can end up earning about 56% more than non-college graduates, these higher education costs can be well worth it.7

“The experience of raising children can create lifelong memories you can never put a price tag on.”

FINANCIAL LESSON:THE JOY OF KIDS & FAMILY MAKES THE COSTS WORTH IT

Whether you’re raising a young child, sending your kid off to college, or watching your kids raise the next generation, kids cost a lot in America. There’s no getting around that.

And money is just one way you’re spending on your kids. In fact, research shows that parents aren’t just spending more money on children these days—they’re also spending more time and energy on their kids than ever before.8

Why?

Because parents and grandparents want to give the kids in their family the best possible life.

Often, that means doing more than just housing, feeding, and educating kids. It can mean taking them to ball games and concerts, paying for special lessons, throwing memorable birthday parties, taking vacations, and more. These activities and experiences you enjoy with your children can create lifelong memories you can never put a price tag on.

Of course, all of that does come with some up-front costs. But I think most parents would agree that the costs are worth it.

If you’re thinking about how to balance the costs of kids with your personal needs and future, call my office. I’ve helped lots of parents and grandparents figure out ways to give their kids a great start while still saving for the future, and I’d be honored to help you, too.

Richard Archer, CFA, CFP®, MBAArcher Investment Management

SOURCES & DISCLOSURES

1 Cost of Raising a Child

Child Care Costs 2015 Report

2 Child Care Costs in the United States

5 2017 Health Care Cost and Utilization Report

6 Trends in College Pricing 2019

Tuition Inflation

7 Pay Gap Between College Grads and Everyone Else

Risk Disclosures: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. The S&P 500 is an unmanaged composite index considered to be representative of the U.S. stock market in general. All index returns exclude reinvested dividends and interest. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. For illustrative purposes only.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. These are the views of Finance Insights and not necessarily those of the named representative or firm, and should not be construed as investment advice.