Moving Towards a More Global Investment Strategy

Twingo. Clio. Polo. Ibiza. Do you know what these are? Maybe Caribbean islands? Possibly the names of Angelina Jolie’s children? Surprisingly, these are the most popular cars on the Spanish island of Tenerife, 90 miles north of Morocco. I only know this because I tallied them as they passed me on my four-hour bicycle ascent up the famous mountain El Teide.

I consider myself a “car guy,” yet I had never heard of these cars. I find that the more I travel, the more my eyes are opened to the fact that there are people living very different lives from mine who have valuable perspectives. This simple car analogy reminds me that I need to travel more and expand my viewpoints and knowledge beyond my everyday life in Austin, Texas.

CHALLENGING OUR PRECONCEIVED IDEAS

Table of Contents

It’s easy to think I’ve got everything figured out. I know where I want to live, what I like to eat, and the best places to ride. But that’s not the reality. Those things may be comfortable and familiar, but I keep finding new favorite things in new places. For example, Gran Canaria has the most difficult climbing in the world (not Boulder, CO), and I might like speaking Spanish more than English because it flows better!

This past election brought up plenty of talk about our personal “bubbles,” but many of us don’t take the time and effort to recognize our own bubbles that we base everything else on. It takes habit and discipline to look at things from a different perspective and learn other ways to do things.

For example, at one of my nightly team dinners, I sat near a Brazilian couple and listened attentively as they took me for a personal tour of South America. As I heard their thoughts, my limited life bubble seemed in stark contrast to their worldliness, and my preconceived notions were challenged. In their minds, Brazil is the “America” of South America, big and diverse with the best beaches in the northern part of the country (please don’t let this secret out!). Argentina is like France, where residents feel culturally elite and more refined than their South American neighbors; and Chile is most like Canada, friendly and inviting. Now that I know more about South America from their point of view, it feels less daunting for me to travel there, and Chile may show up on a future itinerary of mine.

It was fascinating to hear them thoroughly discuss a topic I had never taken the time to consider. I quickly learned that my worldview is greatly limited by my lack of experience. Just like most of us, I tend to favor the familiar and fear the foreign because I don’t know any differently. America is the best at everything after all, right? This concept goes beyond travel, it relates to your portfolio as well.

THINK OUTSIDE OF THE INVESTMENT BOX

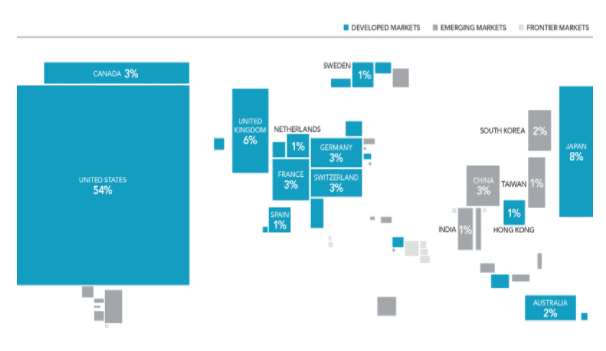

When I was a young investor, my portfolio leaned heavily towards familiar U.S.-based investments. In my mind, they were certainly less risky than unfamiliar foreign holdings. But I soon learned that there is a world of opportunity in equities. Did you know that the weight of the U.S. stock market relative to the global market is approximately 54%? As shown below, nearly half of the world’s investment opportunities are outside of the U.S., with non-U.S. stocks representing more than 10,000 companies in over 40 countries.

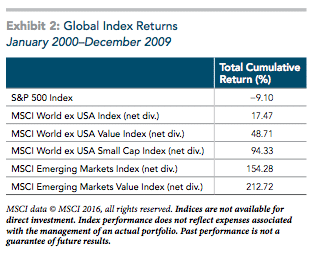

Although U.S. stocks have been in favor the last few years, this has not always been the case. January 2000 – December 2009 is known as the “Lost Decade” because U.S.-only investors lost money cumulatively over those 10 years. Here’s a look at how the market played out during that period:

Exhibit 2: Global Index Returns January 2000–December 2009

Diversification is Key

Over the last 20 calendar years, the U.S. has been the best performing country twice, and the worst performing country once. Global diversification implies that an investor’s portfolio is unlikely to be the best or worst performing, instead providing the means to achieve a more consistent outcome. It helps reduce and manage catastrophic losses that can be associated with investing in just a small number of stocks or a single country.

It’s important for us to expand ourselves with new experiences and knowledge as well as seek diversification in our portfolios. Not only does it improve our quality of life, but it also makes us more understanding of others and lessens extremes. If you are curious about global markets or worried that your portfolio isn’t globally diversified enough, I’d love to talk to you. Click here to schedule a phone call. To close, te veré en Santiago (I’ll see you in Santiago)!

About Richard

Richard Archer is a financial advisor and the President of Archer Investment Management with more than eighteen years of industry experience. Largely working with successful individuals and couples, he specializes in providing comprehensive investment guidance and personalized care and attention to each client. Along with holding a Bachelor of Science in Economics and a MBA, he is a CERTIFIED FINANCIAL PLANNER™ certificant and a Chartered Financial Analyst®. He combines his advanced industry education and knowledge with his genuine care for people to provide clients with an exceptional experience. To learn more about Richard, connect with him on LinkedIn or visit www.archerim.com.